Receiving funds at your doorstep when needed is a convenient option. Due to having no bank account or a low income, it becomes difficult to cover even the basic expenses. Home collection or doorstep loans in Ireland are designed to help you in such circumstances.

Over time, alternative direct lending options have made borrowing more accessible. Gobigbucks offers short-term loans in Ireland and is known for offering affordable deals. Unlike banks or traditional lenders, we don't have a lengthy loan procedure.

You can borrow funds without a guarantor or collateral, provided you have the ability to repay. Your creditworthiness will be measured using your current income sources. Use a free loan calculator without worrying about a search footprint, as it offers doorstep loans with no credit check and a credit assessment tool.

Do not let a financial crisis disrupt your financial peace. Borrow money as per your repayment ability, pay for your expenses and repay on time. For your convenience, all loan deals are customised to make instalments pocket-friendly.

Synonyms for doorstep loans

The doorstep loans are a specialised home credit service offered by lenders. It facilitates receiving funds at home without any lengthy loan process. In direct lending loans, the application process is partially online and partially offline. Without obligation, the complete process becomes effortless compared to expensive provident doorstep loans in Ireland, which are available online.

The loans with home service work through a simple process that is easy to follow for all borrowers. Follow the steps below, and your money will arrive at your door.

The process is the same whether you apply for the doorstep loans in Dublin, Waterford, Cork, Kilkenny or anywhere else. For all locations, the primary aim is to make borrowing hassle-free.

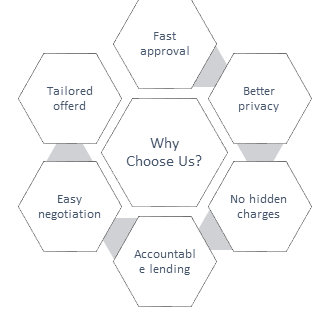

With the following advantages, you can immediately make up your mind about home collection loans.

Responsible lending is all about helping borrowers make rational decisions. Hence, you should also be aware of the risks and challenges associated with urgent doorstep loans.

Doorstep loans have high interest rates, considering the beneficiaries are usually high-risk. Knowing the cost will help you work more effectively on a repayment budget. However, customisation helps a lot in getting an affordable deal.

| Representative APR | Rate of interest | Amount | Term | Total repayable |

|---|---|---|---|---|

| 187.2% APR | 60.0% p.a. fixed | €500 | 26 weeks | €650 |

Formula to calculate the cost –

Monthly Instalment= P x r x (1 + r)n

------------------------------------

(1 +r) n - 1

Instalments = Repayment per period

P = principal (amount borrowed)

r = interest rate per period (APR ÷ number of periods)

n = total number of repayment periods

Yes, if you choose to take doorstep loans in Ireland from a direct lender, it is possible. The new lending procedures allow anyone, regardless of their credit score, to borrow funds. Follow the steps below to get approval with a poor credit rating.

You should not only know how to borrow funds, but also understand the application process. Especially, to avoid expensive doorstep loans like Provident in Ireland, know your rights as a consumer. We always help people make informed decisions.

Gobigbucks is dedicated to providing you with the best and most affordable loan offers. We keep you first, removing all the stringent lending policies. You can borrow money as per your repayment ability. A high approval rate of 99% is something that keeps our borrowers quite hopeful about the acceptance of their loan application. We are your answer if you are looking for doorstep loans near me. It is your turn now to experience mental and financial peace while borrowing funds in the comfort of your home.