Are you going through a phase of financial setbacks? Is it related to your unemployment, or have there been many financial urgencies for the last few months? Do not worry, as everyone faces such circumstances. Still, you should be concerned about your credit scores. If you lose them, your chances of financial survival will shrink. What to do? Choose Gobigbucks to go for tailor-made loans for bad credit.

Hoping for financial assistance from traditional lenders may be possible but not practical. Will you agree to their stringent lending norms? Maybe not during such situations. Here, a loan from a private lender in Ireland makes you a smart guy who can think according to the prevailing situation.

Apply now with us and obtain the desired amount of Euros without any involvement of hefty documentation. See below what you can get while applying for a loan with us:

These online loans for poor credit may worry you about higher interest rates. At the same time, you should not feel at risk with Gobigbucks. This is because we have committed ourselves to competitive interest rates in the market. Affordability is the key here. You get what you deserve and are capable of.

Come online and apply for the most legit loans for bad credit in Ireland.

Bad credit loans belong to small loans in Ireland, where you get the money despite having an extremely poor credit score. These are high-interest rate loans but effective in fetching quick funding access during critical times.

Historically, individuals' credit scores have been the major criterion for obtaining loan approval. Lenders show interest in knowing your past financial record. Simultaneously, they do not hesitate to reject your loan request if you have a bad credit history. This is not the case with us. We pursue a liberal approach and vouch to provide you with a second chance.

Loans for people with bad credit act as your financial rescue by bringing funds up to €10,000 with minimum obligations. You can get that amount for a maximum duration of 36 months. Want to know the repayments? We have kept both weekly and monthly loan instalments for you.

As a responsible private loan lender in Ireland, we are ready to serve your financial purposes with fully customised loan deals. You can fulfil multiple purposes with a single loan offer, such as:

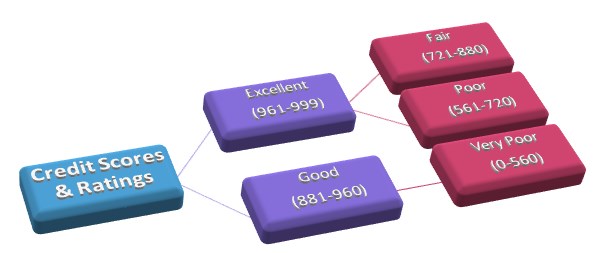

Credit reference agencies have specified categories to judge individual credit scores. These are:

As you can see, you will be considered a person with poor credit scores if your ratings fall under 561-720. Unlike other private lenders, we have broadenedour short-term loans reach to ensure a second chance for a maximum number of applicants.

If you have missed bill payments on credit cards, previous loans, or mortgages and are facing defaults, these extremely bad credit loans are indeed for you.

If you are a first-time loan applicant, you can opt for these loans to accomplish your financial needs. Get a loan and start a positive credit score journey.

Many people have little credit history to show but face difficulty in getting a loan. They can approach us, and we provide a fair chance of borrowing.

If you have a poor credit score, you do not need to approach any other private lender in Ireland. We have been blessed with top financial experts and have proved over the years to be supportive of those with less-than-perfect credit histories.

We have been committed to providing bad credit loans on guaranteed approval. Apart from this, we bring the following loan advantages:

Apart from these benefits, we welcome you to share any concerns during the loan process or duration. We will make proper arrangements so that you can repay the loan without any miss or default.

Guarantor forms an integral part of the loan process. You require a responsible person to take your loan guarantee and get loans at lower interest rates. Problems may occur when you are unable to arrange a guarantor. Our bad credit loans have eradicated such criteria and allow you to get a loan with no guarantor.

Trust is the main issue that halts communication between a person with a bad credit score and another becoming a guarantor. Now, you do not need to think about this part too much. Instead, choose the most legit loans for bad credit in Ireland despite having no guarantor.

You can gain many things without having a guarantor. For instance:

Since the lender does not need any guarantor, you get the approval based on your monthly income. Earning a stable income and ensuring you can afford the loan is important. Get peace of mind early by applying now for the most affordable bad credit loans in Ireland.

Will applying for a loan affect your credit rating? It does. Now, can you get a loan with a poor credit rating? Yes, you can get it. When you can apply for a loan despite a lower credit profile, you can expect a soft credit check approach from us.

Yes, we may treat your application for loans for bad credit with no credit check. In Ireland, credit checks are mandatory, but we mean that with no credit check, there will be no search footprint on your profile.

The condition is that you should be good in your recent handling of bills and other financial activities. At the same time, you should not apply for loans at multiple locations, as it will affect your credit rating.

We are a private loan lender, but at the same time, we also provide fee-free guidance to our loan applicants. We do not want to hide anything. You will know everything narrated in the loan agreement.

Our loan experts have summarised a few points here. You should consider them before seeking loans for bad credit on instant approval in Ireland.

Your poor credit history will restrict your loan approval chances, especially from mainstream lending institutions. It does not mean that you have to sacrifice many things. At GoBigBucks, we have brought bad credit loans in Ireland into the limelight.

The purpose of an online loan application is to ease the financial burden of the applicants. It paves the way for simple steps to submit the loan query. For instance:

We further ease your burden by not asking for too many documents to submit. Your stable income is important to us because that will present your loan affordability. If you are good at that aspect, we are ready to offer many easy loan options despite bad credit. For example, we are among a few lenders providing car loans in Ireland to those with poor credit profiles.

What are you waiting for? Start applying now, get loans for bad credit with instant approval in Ireland and improve your credit score daily.

The eligibility for bad credit loans in the UK requires only the basic requirements. Although it depends upon the type of loans like secured or unsecured.

Here are the common eligibility criteria:

| Condition | Requirement |

|---|---|

| Age and citizenship | You must be above 18 years of age and be a permanent resident of Ireland. You need to give proof of them. |

| Bank account | You must have a valid and active bank account to get the loan amount. |

| Income | Earn a regular source of income such as full-time, part-time, benefits, or self-employment. Minimum monthly income requirement ranges around €800-€900 to qualify. |

| Affordability Check | Show your loan affordability for which lender may require your bank statement, employment status, and pay-slips. |

| Credit Score | Poor or no credit history is acceptable, but you should not have bankruptcy charges and defaults. |

| Guarantor or collateral | If you have applied for a secured bad credit loan, then you will need a guarantor with a strong credit profile or an asset like a car or home to secure the loan. |

Lenders usually ask you to submit a few documents to obtain approval for a bad credit loan. These are more related to your identity, address and income.

Following are the documents you need to get a loan despite a low credit profile:

Identity and address proof: You need to provide valid ID proof like a driver's licence or passport. Besides, lenders want papers related to address proof like utility bills or bank statements of the last 3 months.

Income proof: Share documents related to your monthly income and its affordability. For that, provide salary slips of the last 2-3 months or employment contract (for salaried individuals), tax returns or proof of business income (for self-employed), and proof of benefit receiving (for those living on benefits or pensions).

Credit report (optional): If you have an updated Irish Credit Report, you can share it with the lender. It will allow the provider to personalise a loan deal that matches your affordability.

Apart from these, you need to provide guarantor's details too if you apply for a guarantor loan for bad credit. Similarly, collateral proof is required for a secured loan.